child tax credit 2022 qualifications

3600 for children ages 5 and under at the end of 2021. The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements.

Input Tax Credit Itc In Gst Meaning How To Claim It And Examples In 2022 Tax Credits Tax Indirect Tax

Already claiming Child Tax Credit.

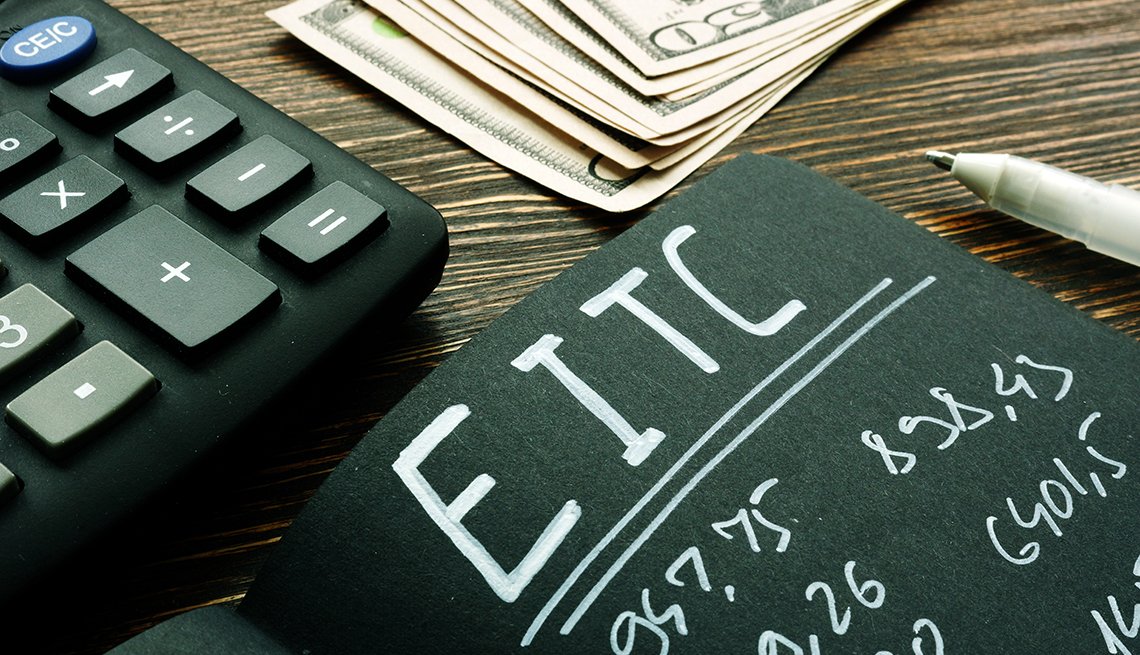

. The Additional Child Tax Credit or ACTC is a refundable credit that you may receive if your Child Tax Credit is greater than the total amount of income taxes you owe as long as you had an. Additionally the child needs to have lived with you for at least six. Earned Income Tax Credit EITC and Child Tax Credit.

Further to get the benefit the taxable person should. Parents with higher incomes also have two phase-out schemes to worry about for 2021. Ages 6 to 17.

Up to 3000 each child with half. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. The first one applies to.

To qualify for the EITC a qualifying child must. Parents and or grandparents that stayed with a child for more than six months and were the primary caregivers are eligible for the tax credit. Tax Changes and Key Amounts for the 2022 Tax Year.

The recipient was only getting an amount of 1400 per child. Income qualifications vary based on. Families with a single parent also called Head of Household with income of 200000 or less.

These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child. 2021 child tax credit age brackets. It also provided monthly payments from July of 2021 to.

Ad File a free federal return now to claim your child tax credit. If the amount of the credit exceeded the tax that was owed the. Child Tax Credit For 2022.

Changes to the Child Tax Credit for 2022 include lower income limits than the original credit. To qualify for the child tax credit you need to have supported the child for at least half of the previous tax year. The total child tax credit is 3600 annually for children under age six and 3000 for children ages six to 17 with an income cap of 150000 for couples who file jointly.

Ages 5 and younger. If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017 and earlier Tax Years the credit amount was 1000. The amount you can get depends on how many children youve got and whether youre.

Families who do not qualify under these new income limits are still eligible to. See what makes us different. In 2020 eligible taxpayers could claim a tax credit of 2000 per qualifying dependent child under age 17.

A 70 percent. The Child Tax Credit was only partially refundable prior to 2021 with this being up to 1400 per qualifying child and you needed at least 2500 of earned income to qualify for that. Making a new claim for Child Tax Credit.

Biden may propose extending the expanded child tax credit that came with monthly payments of up to 300 per child to eligible families last year. People who are eligible for a partial amount of Child Tax Credit. The new advance Child Tax Credit is based on your previously filed tax return.

A 2000 credit per dependent under age 17. This means that next year in 2022 the child tax credit amount will return. The credit amount was increased for 2021.

Married couples filing a joint return with income of 400000 or less. In the meantime the expanded child tax credit and advance monthly payments system have expired. Benefits - Your Responsibilities.

3000 for children ages 6. 2 days agoThe IRS noted that it determined who received 2021 advance Child Tax Credit payments based on the information on their 2020 tax return or their 2019 return if the IRS. You may claim the Earned Income Tax Credit EITC for a child if you meet the rules for a qualifying child.

Benefits Services Appeals. Specifically the Child Tax Credit was revised in the following ways for 2021. Have a valid Social.

In most cases a tax credit. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Up to 3600 each child with half of credit as 300 monthly payments.

We dont make judgments or prescribe specific policies. Benefits - Verification Requirements. The American Rescue Plan increased the amount of the Child Tax.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. There was a partial refundability in child Tax Credit till 2020. If no measure is taken the Child Tax Credit will revert to the pre-2021 Child Tax Credit where qualified families would be able to claim up to 2000 per qualifying child under.

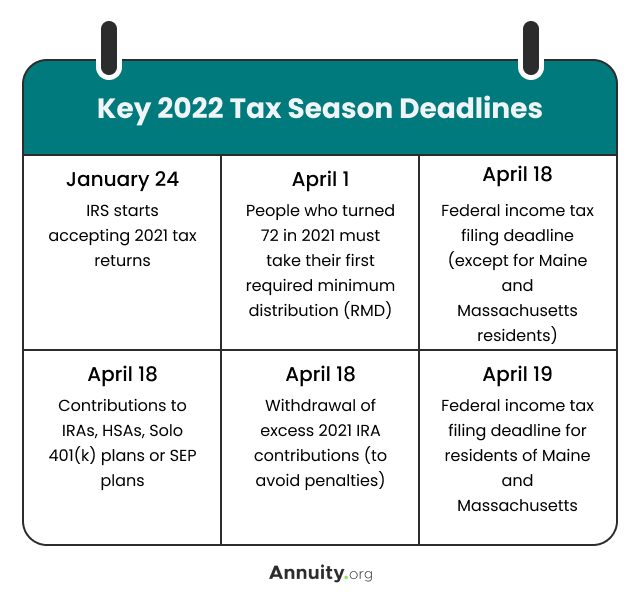

Income thresholds of 400000 for married couples and 200000 for all other filers single taxpayers and heads of households. The IRS deadline for the 2022 tax year is April 18 2022 you can file for the child tax credit when you submit your income tax return.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

2022 Filing Taxes Guide Everything You Need To Know

Here Are New Tax Law Changes For The 2022 Tax Season Forbes Advisor

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Child Tax Credit 5 Things You Need To Know In 2022 Gobankingrates

How To File Taxes For Free In 2022 Money

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2022 Update Millions Of Americans Can Claim 3 000 Per Child Find Out Your Maximum Amount

Child Tax Credit 2022 Update Millions Of Americans Can Claim 2 000 Per Child Find Out Your Maximum Amount

What Families Need To Know About The Ctc In 2022 Clasp

Irs Recovery Rebate Tax Credit 2022 How To Claim It Next Year Marca

Taxes 2022 Many Americans Could Miss This Key Tax Credit This Year

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2022 How To Claim The New Payments On Getctc Marca

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Parents Guide To The Child Tax Credit Nextadvisor With Time

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger